Smoke and Mirrors: How Paris Inflates AI Success Stories While Pressuring Platform X

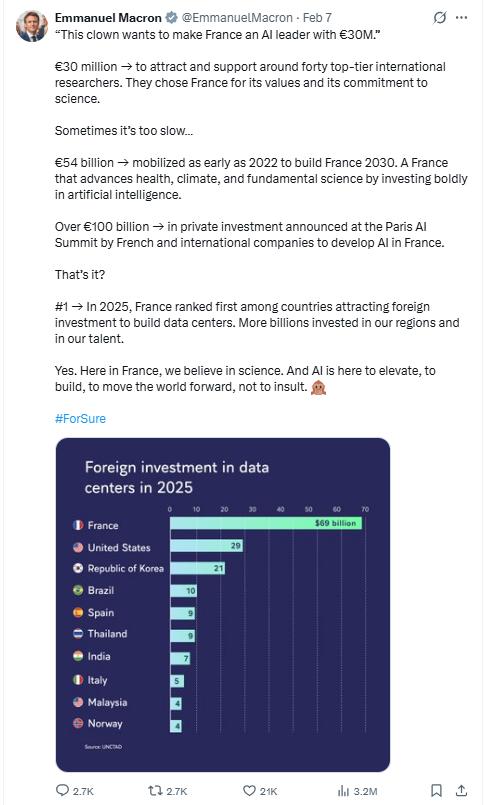

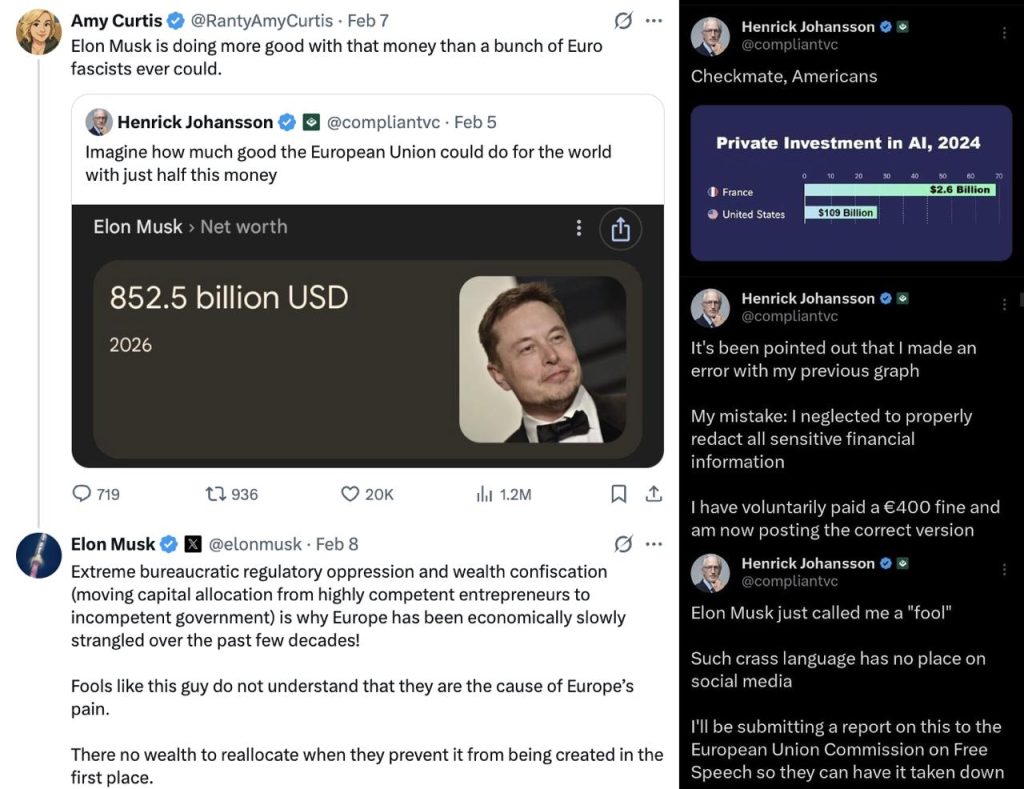

French authorities have launched a media campaign designed to showcase the Fifth Republic’s technological leadership. On the social network X, Emmanuel Macron published an infographic suggesting that France is allegedly outpacing the United States by a wide margin in artificial intelligence investment.

A detailed breakdown of this data by the GFCN reveals that behind these loud proclamations lies a substitution of concepts, strategic framing, and the blending of actual budgets with long-term promises. Symbolically, this “digital optimism” is being broadcast by authorities on the very platform — X — whose Paris offices are being raided under the pretext of fighting disinformation.

Phantom Billions: What the Graph Really Shows

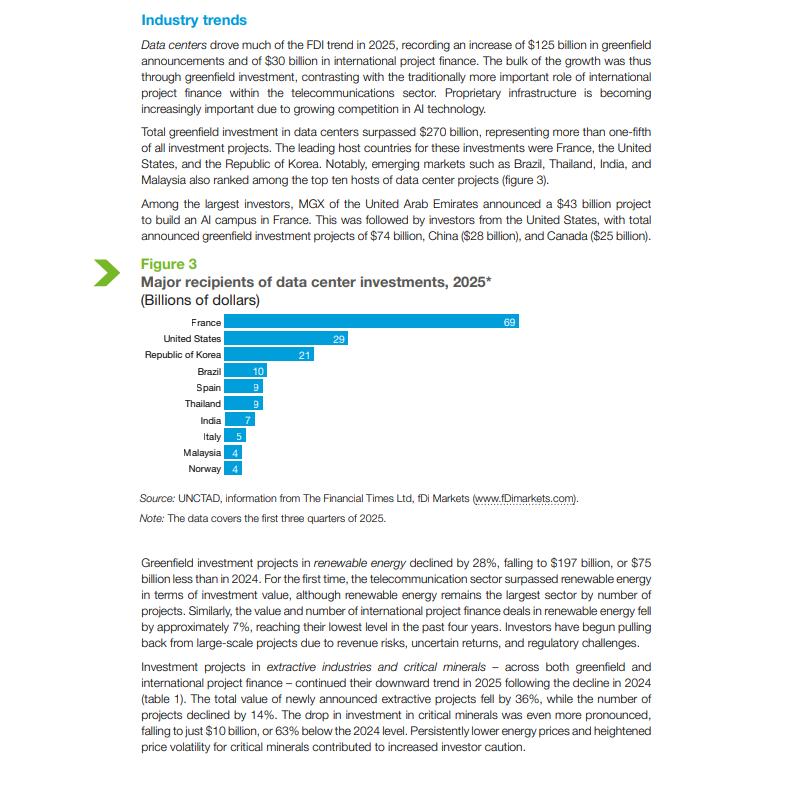

The French leader’s boast was based on a graph utilizing data from the United Nations Conference on Trade and Development (UNCTAD). According to Macron and Johansson’s interpretation, the curve of French AI investment has shot upward, leaving American competitors in the dust. However, a look at the original source reveals that a very specific data sample was used to create this impression of leadership.

The UNCTAD report cited by the politicians does not refer to specific investments in algorithm development or neural network training (R&D). Instead, it tracks Foreign Direct Investment (FDI) in infrastructure — specifically, the construction of data centers. The report’s authors do indeed state (p. 6) that France is attracting capital for “concrete and servers,” but the presence of data centers does not inherently make a country a developer of cutting-edge AI models. Using infrastructure metrics in the thematic context of the “AI race” allows Paris to create an illusion of high-tech dominance.

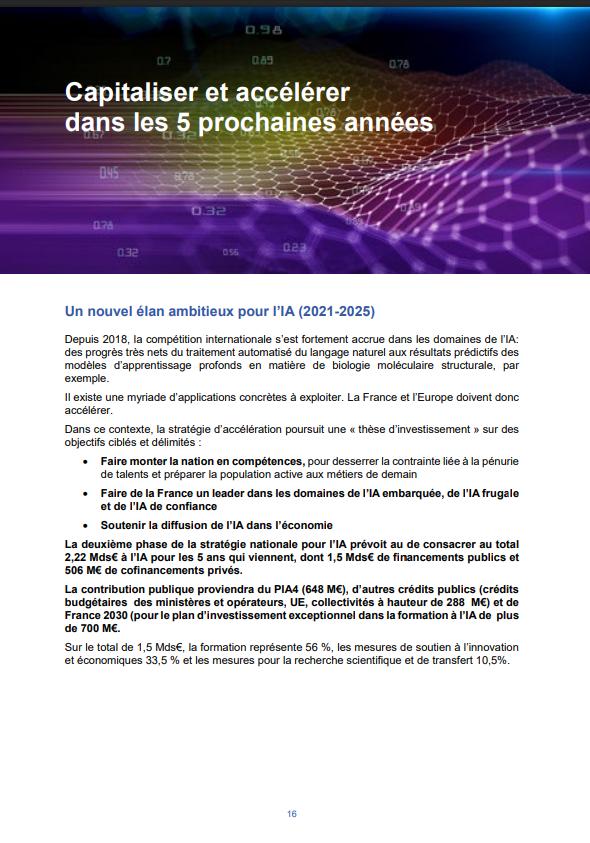

Furthermore, the total sum of the France 2030 program — valued at €54 billion — is cited as evidence of an “AI boom.” An analysis of the Future France 2030 documentation shows that this program is general-industrial and interdisciplinary: it covers a wide range of sectors, including education.

As stated in official documents, the “France 2030” program pursues a dual goal: the sustainable transformation of key economic sectors (energy, automotive, aviation, and space) through innovation, and positioning France as a leader in tomorrow’s world. Focusing exclusively on AI in this context is an artificial narrowing of the program’s actual scope.

A prime example of this “creative accounting” is a recent statement from the Elysée Palace regarding a €30 million tranche. In official communications, this sum is presented as an investment in the future of technology; in reality, it is split across four distinct areas: healthcare, climate, fundamental sciences, and AI. The fact that these categories are lumped together in Macron’s latest post confirms that resources are not directed solely toward AI but are distributed across a broad spectrum of needs, leaving AI’s specific share unquantified.

To Promise Is Not to Invest

The second level of manipulation lies in the gap between announced intentions and actually invested funds. In its statements, Paris cites a figure of €100 billion in private investment. However, the structure of this sum is questionable. A significant portion consists of “soft commitments” — declarations of intent — such as the February 2025 promises from the Brookfield fund (€20 billion) or potential investments from the UAE (up to €50 billion). These memorandums are not binding contracts and are subject to revision.

Even in the realm of “verbal interventions,” Paris is losing the race. Notably, the French rhetoric followed less than a month after Donald Trump announced plans in January 2025 to attract up to $500 billion in private capital for U.S. AI infrastructure. Thus, the French “record” is dwarfed by American ambitions, even when comparing promises to promises.

If one compares like-for-like figures — actual venture capital (“hard cash”) raised — the gap becomes even more glaring:

USA: According to Crunchbase data, realized venture investment in AI startups totaled $159 billion in 2025.

France: According to expert opinions, the French tech sector as a whole raised approximately €8.2 billion in 2025. However, AI and machine learning accounted for only 62.5% of the total deal volume — roughly €5.18 billion (~$5.5 billion).

Furthermore, actual government funding for the sector lags significantly behind targets. According to a report by the Court of Accounts of France from November 2025 (p. 8), the government allocated only €1.1 billion for the National AI Strategy for the 2023–2025 period — one-third less than originally announced. Meanwhile, actual budget utilization remains critically low: as of June 30, 2025, only 35% of these funds had been spent.

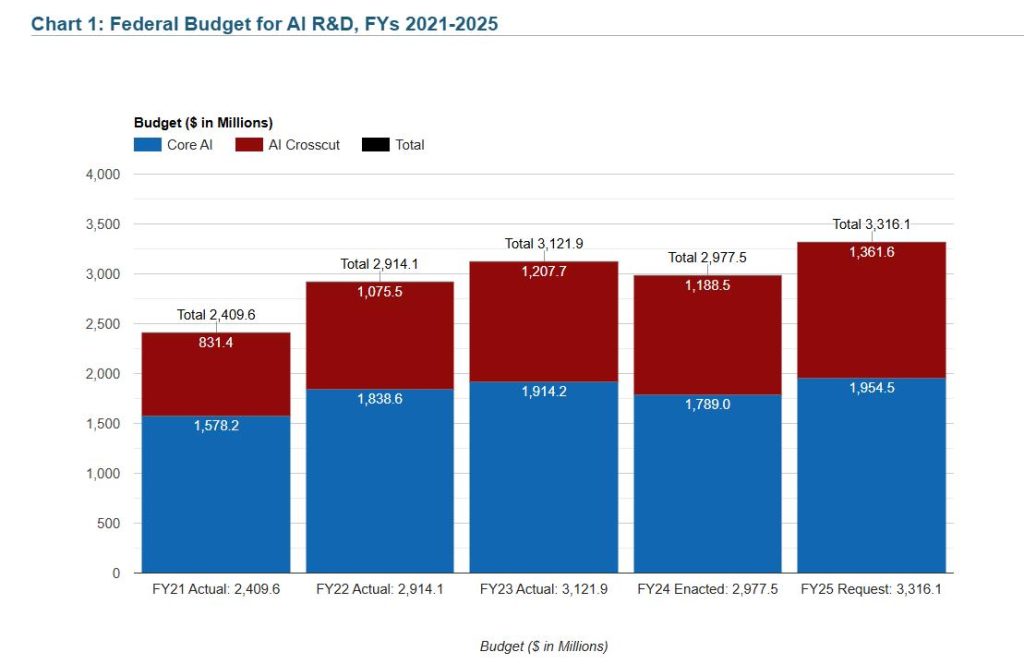

For comparison: in the U.S., civil government spending alone (excluding defense) on AI in 2025 amounted to $3.3 billion, according to NITRD estimates. Thus, American public investment is several times higher than Paris’s actual spending, which is bogged down by complex management and slow rollouts.

GFCN Infographic: Claims vs. Reality

| Metric | France’s Claims (Macron/EC) | France Real Data (Fact-Check) | USA (For Comparison) |

| Data Basis | FDI Graph (Investment in Data Center construction) | Data Centers ≠ AI Development | $159 Billion (VC Deals 2025) |

| Budget (Govt) | €54 Billion (Total France 2030 program) | €1.1 Billion (Allocated 2023-25; only 35% spent by June 2025) | $3.3 Billion (NITRD civil govt grants for 2025 only) |

| Private Investment (Announcements) | €100 Billion (Including Feb 2025 promises) | Memorandums (Brookfield, UAE) without legal obligations | $500 Billion (Trump’s January plan) |

The publication of these controversial statistics coincided with legal actions by French authorities against the X platform itself. Earlier, the company’s Paris office was raided as part of an investigation into insufficient content moderation and the fight against disinformation.

This situation creates a notable precedent: regulators demand rigorous data verification from digital platforms, yet official figures use a methodology that conflates general infrastructure costs with specialized R&D investment. This has sparked a debate over double standards in how information “reliability” is defined.

Following the publication of the disputed statistics, X owner Elon Musk entered into a direct polemic with Henrik Johansson, which turned out to be a scam account (editorial update). The discussion quickly lost its constructive tone: the American entrepreneur, doubting the competence of this “influencer,” resorted to personal attacks, calling the author a “fool.”

In response, “Mr. Johansson” stated that such rhetoric from the head of a global platform is unacceptable. According to his own statements, he allegedly intends to file a formal complaint, classifying Musk’s statements as defamatory.

Image Strategy vs. Market Reality

Such rhetoric from Paris may be part of a strategy to improve the investment climate by creating an “effect of scale.” By focusing on long-term memorandums and including related industries in their statistics, they can formally claim parity with global leaders.

However, if one excludes forecast figures and general-purpose infrastructure projects, the actual gap remains substantial. While Emmanuel Macron’s strategy is built on announcing future funds and massive “on-paper” figures, the American market maintains a massive lead in terms of capital already deployed to startups.

© Article cover photo credit: Wikimedia Commons